reit dividend tax canada

35 rows The Best 4 Canadian REITs. The tax withholding applies to REITs held in tax-sheltered as well as regular accounts.

How Dividends Are Taxed In Canada Dividend Tax Credit Gross Up Explained Youtube

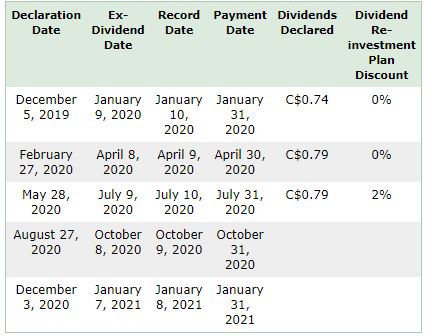

In mid-March this Canadian REIT reduced the monthly distribution to 003.

. 5 Year Dividend Growth Rate. Further to this Allied is one of only 8 REITs which have achieved Canadian Dividend Aristocrat status. In 2013 and the grocery chain is its biggest tenant today.

When they flow their income through to their unitholders the REITs dont pay much if any corporate tax. 1116 on the next 57546. 28 rows While US.

Trustees of the REIT are generally subject to fiduciary duties similar to those applicable to. Investment income is taxed at 8. 15 tax rate if shareholder owns more than 50 of the REITs voting stock.

Ontario tax rates by tax bracket are shown below. Even though only half of the capital gains are included in taxable income the capital gains marginal tax rate is 1250 percent or half of the regular income marginal tax rate. In 2026 the budget will rise to 6 with an additional 3.

Capital gains are taxed at a rate of 50 in Canada and the investor must include this in their taxable income. The marginal tax rate for qualifying dividends is only 2. For example BTB REIT TSXBTBUN trades at only 398 per share but the small-cap stock is a dividend beast.

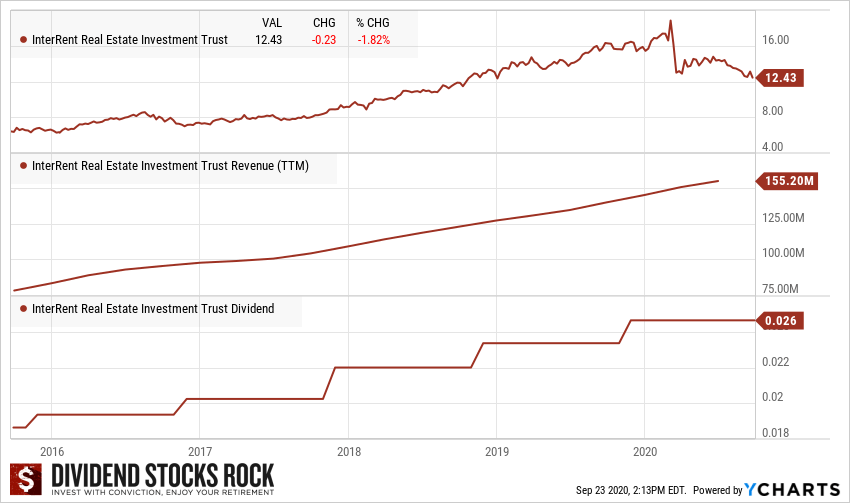

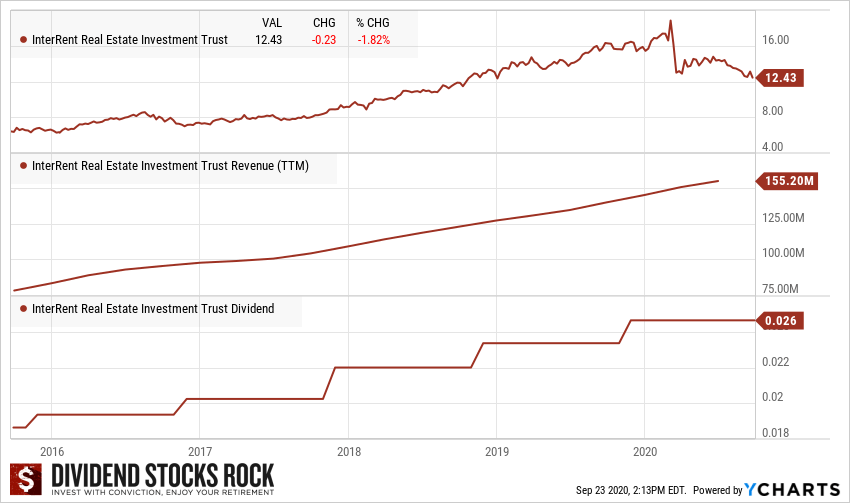

As of writing Allied is still trading at a 16 discount to June 30 2021 NAV of 4907 per share. REITs typically pay quarterly dividends most Canadian REITs pay monthly. So your 6000 annual limit for 2022 can earn an extra tax-free income 3750 per month.

Melcor acquires manages and leases commercial property in Western Canada. If you have 50000 in capital gains in BC you will pay 141 tax 50 of your capital gains are taxed at the marginal rate and average tax rate of 477 which equals about 2384. More about REITs Canada Canada offers special tax treatment for Canadian income trusts.

Dividends from REIT companies are generally taxable as ordinary income above the maximum rate of 37 395. The 200 eligible dividend had a grossed up value of 200 x 138 276 so your federal tax credit 276 X 150198 percent 4145. The tax rates in the chart apply to REIT capital gain distributions so long as the non-US.

505 on the first 46226 of taxable income. Choice Properties is a Real Estate Investment Trust that owns manages and develops retail and commercial real estate across Canada. Investor owns 5 or less of a.

The 200 other than eligible dividend had a grossed up value of 200. In the case of Bulgaria Canada and the Netherlands 0 also only so long as not from carrying on a. Taxpayers who hold Canadian dividend-paying stocks can be eligible for the dividend tax credit in Canada.

REITs voting stock and in the case of REIT dividends paid to a c orp or ati n esid tin C yprus r Eg pt m h5 f. Melcor REIT TSXMRUN is one such company. 2 hours agoYou can be a mock landlord in different sub-sectors within the real estate industry.

Additionally from tax time until Dec. 915 on the next 46228. When reinvested the rate rises to 42.

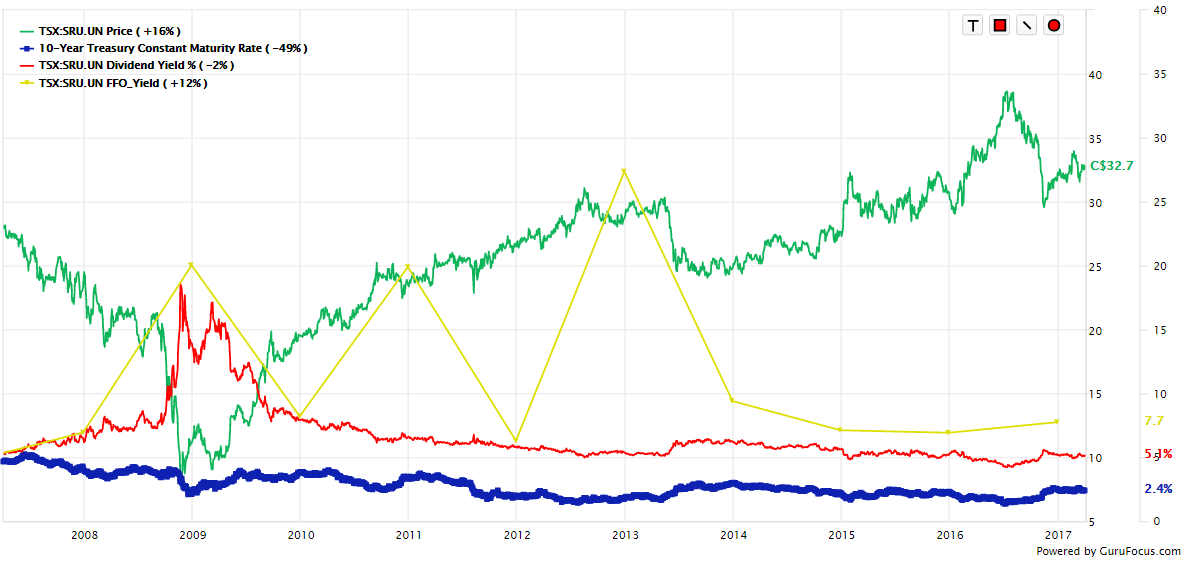

Jamaica and no more than 25 of the REITs income consists of dividends and interest. Capital gains taxes are very similar to those incurred when buying United States-domiciled stocks. The nice thing about being anchored by Walmart is that Walmart provides a lot of stability.

The most recent credit values are 150198 of the taxable eligible dividends amount and 90301 of the taxable other than eligible dividends. Drum roll please and if you have 50000 in eligible dividends in BC you will pay 0 average tax rate in taxes which is 0 ZERO DOLLARS. When a shareholder receives a dividend they have to declare the dividend on their income tax return.

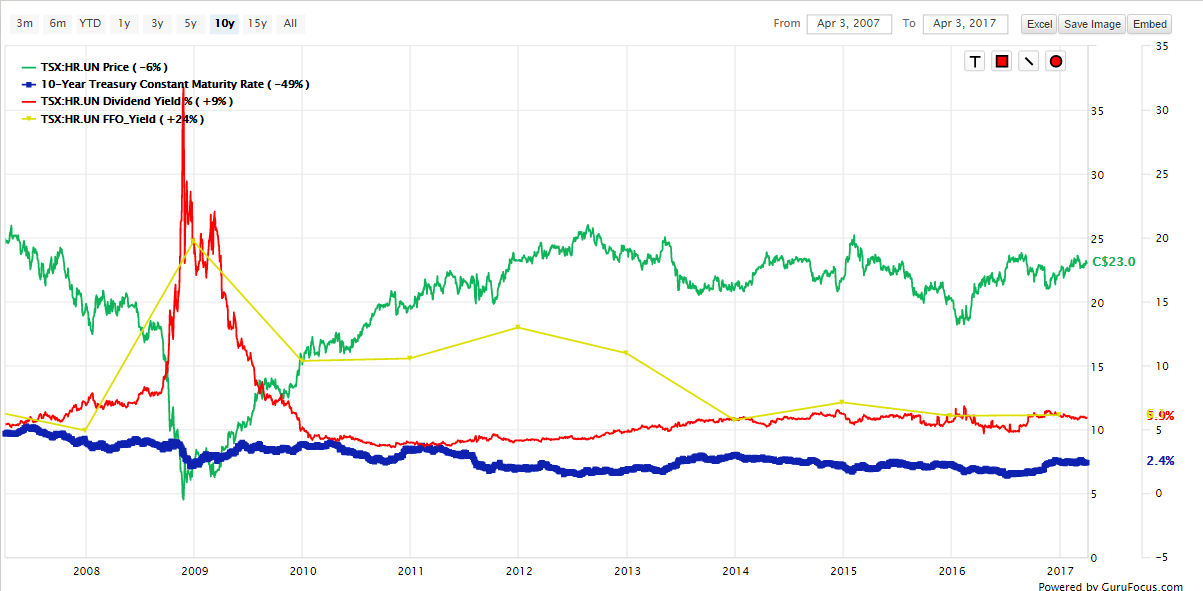

It has an attractive yield and the distribution is well covered with an FFO payout ratio of 7190. 31 individuals should deduct 20 of their qualified business. 30 tax rate if shareholder owns 25 or more of the REITs stock.

The Canadian government imposes a 15 withholding tax on dividends paid to out-of-country investors which can be claimed as a tax credit with the IRS and is waived when Canadian stocks are held in US retirement accounts. 20 tax rate if shareholder owns at least 10 of the REITs voting stock. Trustees of the REIT hold legal title to and manage the trust property on behalf of the unitholders of the REIT.

Investors pay tax on most of the distributions as ordinary income although part of some distributions qualify as a tax-free return of capital. Tax Issues The Canadian government requires that REITs withhold 15 of shareholder distributions defined as return on capital. Choice Properties was spun out by Loblaw Cos.

Walmart is a big tenant for SmartCentre REIT with 73 of its properties anchored by Walmart and more than 25 of revenue coming from Walmart. Dividends are taxes at the federal and provincial levels. REIT is governed by and established pursuant to a declaration of trust.

As mentioned provincial tax rates vary by province. Investors in the highest tax bracket pay tax of 39 on dividends compared to about 53 on interest income. High-quality tenant base.

22 minutes agoThe post 1 REIT Stock Yielding a Massive 75 Dividend appeared first on The Motley Fool Canada. As ordinary income a majority of REIT dividends return to 396. This means that dividend income will be taxed at a lower rate than the same amount of interest income.

When calculated by taking into account the 20 deduction a Qualified REIT Dividend usually pays the highest tax rate of 290. True North Commercial TSXTNTUN trades at less than 10 744 per share but pays an ultra-high 802. REITs are trusts that passively hold interests in real property.

The Canada Revenue Agency applies a 150198 tax on the tax portion of eligible dividends and a 9031 rate on the tax portion of non-eligible dividends. The REIT collects rental income pays its expenses and then distributes almost all its remaining incomeusually 85 to 95to unit. An investment tax surcharge of 8 applies to income.

In 2026 the rate will increase to 66 but there will be a separate 31 increase. Examples in this article will use Ontarios tax rates as it is Canadas most highly-populated province.

Reits Canada Still Offers Tax Advantages For These Investments

Introduction To Canadian Reits Seeking Alpha

Reit Taxation A Canadian Guide

I Did All The Due Diligence For Canadian Reits Based On Their Q2 Reports Take A Look At This Table R Canadianinvestor

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Stock Investors Hungry For Yield Shun Canadian Reits In Downturn Bnn Bloomberg

Reit Taxation A Canadian Guide

Top 3 Canadian Reits For 2020 And Why Riocan Is Not Part Of It Seeking Alpha

Canadian Taxes For U S Investors The Comprehensive Guide

13 Best Monthly Dividend Stocks In Canada For Passive Income 2022

Canadian Reits Vs U S Reits Which Are Better Buys For Canadians

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Royal Bank Of Canada Tsx Ry Nyse Ry And Another Stock Are Solid Dividend Ideas Stock Market Crash Economic Trends Stock Market

24 Best Canadian Reit Stocks 2022 Invest In Real Estate

Introduction To Canadian Reits Seeking Alpha

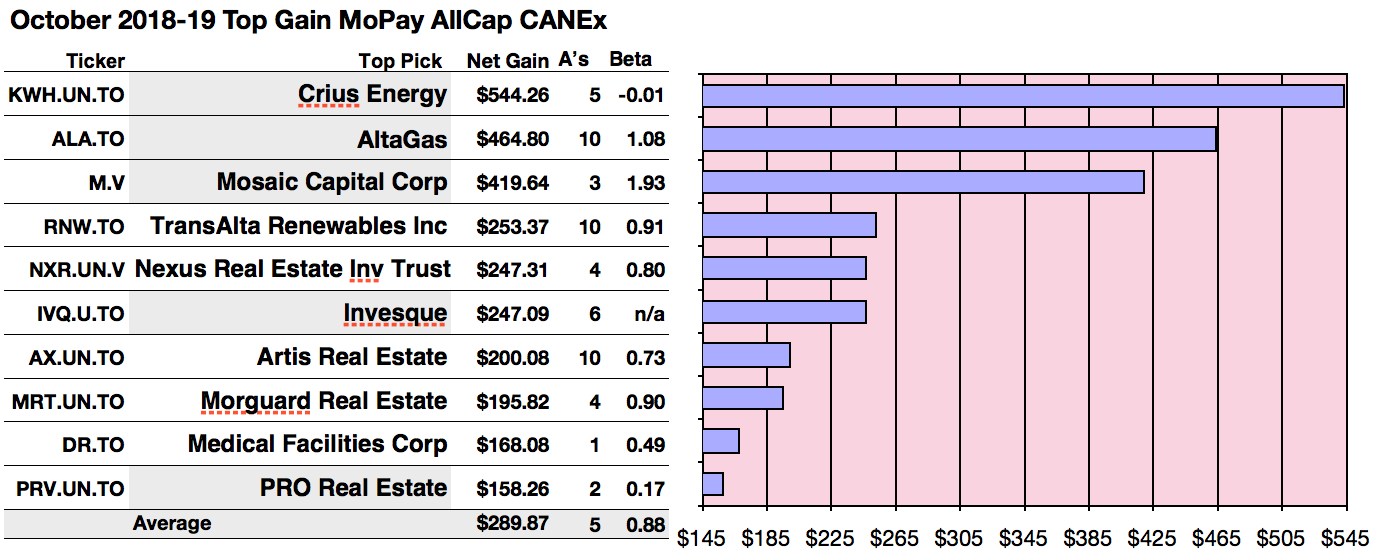

Top 10 Monthly Paying Canadian Dividend Stocks With Large 1 Year Projected Gains Seeking Alpha