tax saving strategies for high income earners canada

New legislation now challenges high earning Canadians by either eliminating or significantly reducing the benefits of these two tax. Try a 14-day free trial today.

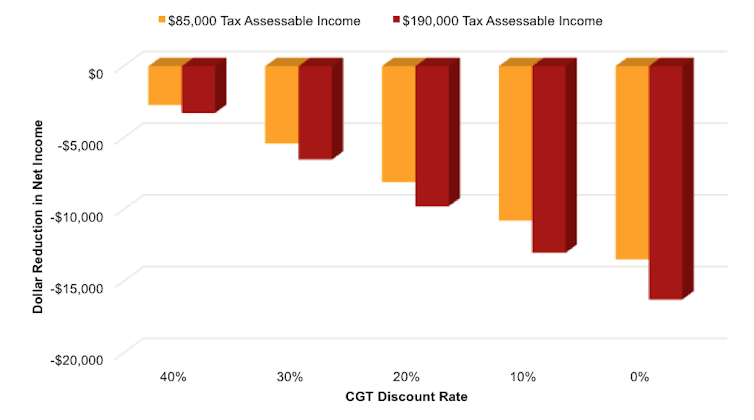

Negative Gearing Reforms Could Save A 1 7 Billion Without Hurting Poorer Investors

High-income earners should consider investing in municipal bonds.

. Taking advantage of tax-saving vehicles available through your employer or business. 5 Reduce Taxable Income with a Side Business. Discover several strategies that make for a tax-smart wealth plan.

With your qualified tax advisor. Income splitting and trusts. David Rotfleisch founding tax lawyer of Toronto firm Rotfleisch and Samulovitch recommends Registered Retirement Savings Plans RRSPs to everyone.

In fact Bonsai Tax can help. For any Canadian with the ability to save money sheltering income from the taxman in one of the two main savings vehicles the government makes available is a no-brainer. RRSP contributions are tax deductible and any income and gains earned inside a RRSP are not.

Even worse high income earners are working Monday Tuesday and some of Wednesday just to pay the tax man. However prior to the 2018 federal budget high earning individuals enjoyed two effective strategies to reduce their overall tax burden income splitting and reinvesting undistributed earnings from an active business into a private corporation. Another popular way to reduce taxable income is by maximizing the benefits of tax-advantaged retirement accounts.

Deferring income taxes to lower-income tax years. This way individuals assure that the money put aside by the low income earner will be taxed at a lower tax rate when eventually withdrawn. Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job.

This has to generally be done within annual gift exclusions or loans. Further there will generally be no income. Top Tax-Saving Strategies for High-Income Earners in Canada Registered Retirement Savings Plans RRSPs.

Users typically save 5600 from their tax bill. All the investment income in the TFSA grows tax-free and future withdrawals are not taxable. Tax-Free Savings Accounts TFSAs.

Make a contribution each year to your RRSP Registered Retirement Savings Plan to the maximum amount allowed ie. These retirement accounts use pre-tax money so you can deduct your contributions from your taxable income. Our tax receipt scanner app will scan your credit card bank statements to discover tax write-offs and maximize your savings.

Ad Get a Personal Portfolio recommendation to see which strategies might be right for you. As a high income earner in Canada you likely qualify for the maximum RRSP. Structuring your investments to be tax efficient.

The first way you can reduce your taxable income and therefore. If theres potential for a high return by investing a smaller amount of money upfront Roth can be the way to go. The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income.

The biggest advantage. Grow Your Financial Health With this AARP Money Saving Smart Guide. View transcript Tax-Free Savings Accounts.

Interest payments on the earnings are tax-free. We seek to help safeguard your wealth by planning for your goals and managing market risk. Sheltering investment income.

Make Retirement Plan Contributions. If youre wondering why you should do so here are some of the ways it can help you to lower your tax bill. According to the ATO youre classified as a higher income earner if you earn over 180000 a year.

Tax Saving Strategies for High-Income Earners. Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need. Under RS rules you can deduct charitable cash contributions of up to 60 of your adjusted gross income.

Tax Savings Strategies Tax planning strategies for high-income earners Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds a set amount. In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege. For every dollar you earn youre giving up nearly half to the tax man.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Tax-Free Savings Account TFSA In addition to investing in a TFSA of your own consider making a gift to your adult family members or spouse to enable them to contribute to a TFSA. Ad Start Small and Spend Smart.

RRSP limit for the year. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses. Strategic Leaders Who Will Address Your Urgent Critical Complex Situations Learn More.

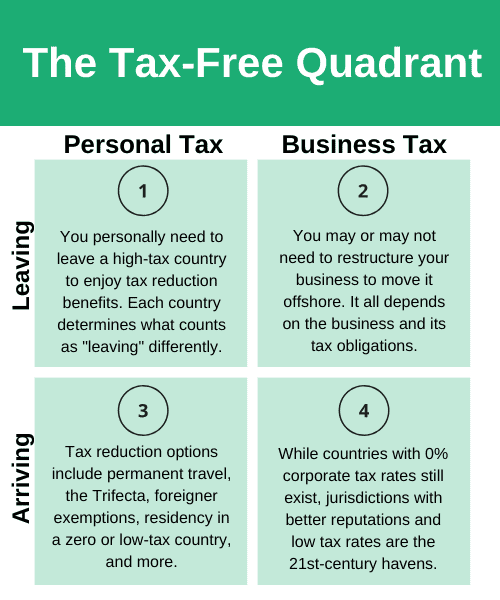

Check Out This AARP Money Saving Smart Guide. They borrow cash in exchange for fixed payments. Broadly speaking tax planning involves the following.

Ad Support You Need to Achieve Your Corporate Finance Strategy Objectives. If properly structured family trusts or partnerships can help you move your investment earnings to family members with lower marginal tax rates. Bonds mature with an initial return for the buyer.

There are a few ways to take advantage of charitable deductions including. Income splitting Have the higher income earner pay all the expenses and the low income earner save as much as possible. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax.

One of the most popular tax-saving strategies for high-income earners involves charitable contributions. Deductions for contributions of non-cash assets are capped at 30. Specifically contribute to a traditional 401 k or IRA.

Income splitting and trusts This is one of the most important tax strategies for you as a high-income earner. Convert your SIMPLE SEP or traditional IRA to a Roth IRA. Change the Character of Your Income One way to reduce your tax burden is to change the character of your income.

Your RRSP limit for the current year 2018 is shown on your 2017 Notice of Assessment. Tax Planning Strategies for High-income Earners. Ideally the high income earner will even pay the low income earners tax liability.

Taking advantage of all available income tax deductions and tax credits. We often recommend giving every 35 years to maximize deductibility and to make sure that contributions are being used in the most efficient way possible. Another common tax-saving strategy in Canada is the TFSA.

The earnings of the tax-exempt bond are typically excluded from income taxes including state income taxes and local income tax rates.

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Entrepreneurs Here S How To Pay Less Taxes

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

How To Save Money On Tax Reduce Taxable Income Finder

How To Save Income Tax In India With No Investment Youtube

High Income Earners Need Specialized Advice Investment Executive

Tax Minimisation Strategies For High Income Earners

How To Reduce Tax Legally By Paying Less Bas Australia Box Tips Youtube

The Canadian Income Taxation Statistical Analysis And Parametric Estimates Kurnaz 2022 Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

How To Save Income Tax In India With No Investment Youtube

2020 21 Tax Cuts Everything You Need To Know Etax Online Tax

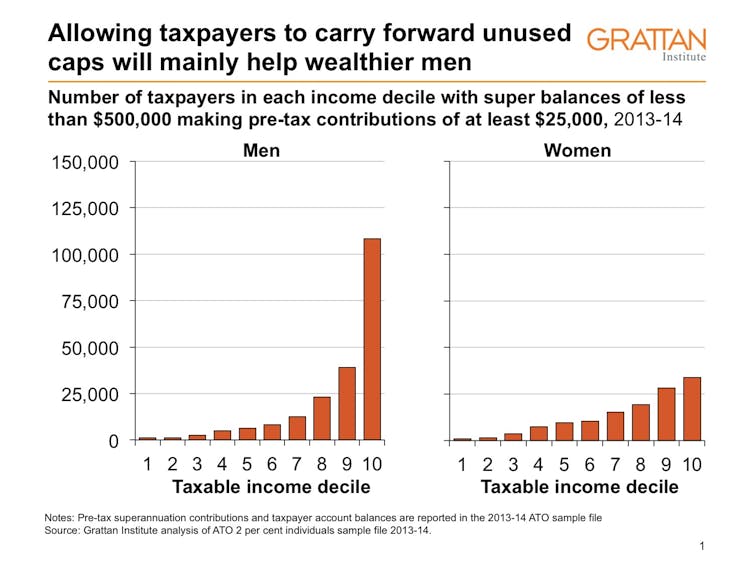

Super Contribution Cap Changes Could End Up Benefiting The Rich

Warning Don T Hide Your Foreign Income From Ato And Know The Tax Implication Right Accurate Business Accounting Services Campsie Tax Returns 49

Taxable Income Formula Examples How To Calculate Taxable Income

Tfsa Vs Rrsp How To Choose Between The Two 2022 Canadian Money Retirement Advice Finance Blog

/savingmoney-04b094637ffb4768a3fad0f95a47071c.jpg)